[ad_1]

Market Overview 2025-2033

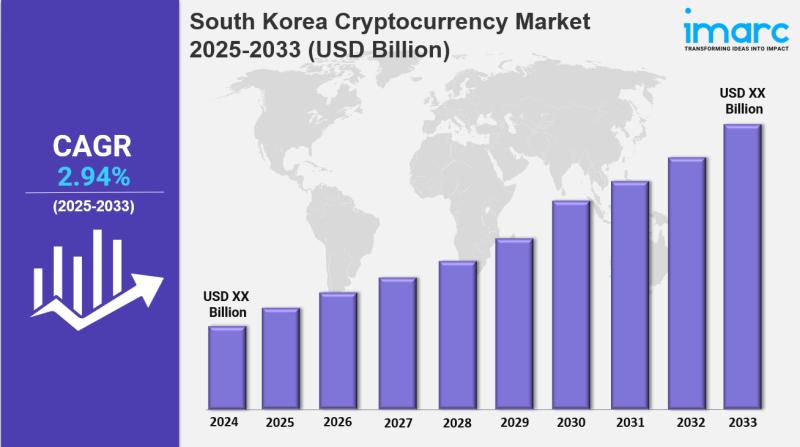

South Korea cryptocurrency market size is projected to exhibit a growth rate (CAGR) of 2.94% during 2025-2033. The market is witnessing substantial growth, propelled by heightened interest in digital assets, technological advancements, and a supportive regulatory framework. Key trends include the increasing adoption of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), with major players emphasizing security and user-friendly interfaces to attract a broader audience. Additionally, the rise of institutional investment in cryptocurrencies is further driving market dynamics, as traditional financial institutions explore blockchain technology to enhance their offerings.

Key Market Highlights:

✔️ Significant growth driven by increasing interest in digital currencies and blockchain technology

✔️ Rising demand for decentralized finance (DeFi) solutions and non-fungible tokens (NFTs)

✔️ Enhanced focus on regulatory compliance and security measures to protect investors

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-cryptocurrency-market/requestsample

South Korea Cryptocurrency Market Trends and Drivers:

The growing adoption of cryptocurrencies among South Korean consumers is significantly influencing the South Korea Cryptocurrency Market Size. As individuals seek alternative investment opportunities and financial independence, the popularity of digital currencies is surging. This trend is driven by increasing awareness of the benefits of blockchain technology and the potential for high returns on investment.

By 2025, the market is expected to expand further as more retail investors enter the space, seeking to diversify their portfolios with cryptocurrencies. Additionally, the rise of user-friendly platforms and mobile applications is making it easier for the general public to buy, sell, and trade cryptocurrencies, thereby contributing to the overall growth of the market.

Another crucial dynamic shaping the South Korea Cryptocurrency Market is the increasing participation of institutional investors. With traditional financial institutions recognizing the potential of cryptocurrencies, there has been a notable shift in the South Korea Cryptocurrency Market Share. Major banks and investment firms are beginning to offer cryptocurrency-related services, which enhances credibility and attracts a broader range of investors.

By 2025, this trend is expected to accelerate as more institutions launch cryptocurrency products, such as exchange-traded funds (ETFs) and managed portfolios. This influx of institutional capital not only boosts market confidence but also leads to greater market stability, fostering continued South Korea Cryptocurrency Market Growth.

Lastly, regulatory developments are playing a pivotal role in shaping the landscape of the South Korea Cryptocurrency Market. The government is actively working to create a more structured regulatory framework that promotes innovation while ensuring consumer protection. These regulations are expected to clarify the legal status of cryptocurrencies and establish guidelines for exchanges and trading platforms.

By 2025, the impact of these regulatory measures will likely enhance the overall South Korea Cryptocurrency Market Size, as they encourage more participants to engage in the market with confidence. As compliance improves, the market will attract both domestic and international investors, further driving growth and establishing South Korea as a significant player in the global cryptocurrency landscape.

Buy Report Now: https://www.imarcgroup.com/checkout?id=21885&method=1370

South Korea Cryptocurrency Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Component Insights:

• Hardware

• Software

Type Insights:

• Bitcoin

• Ethereum

• Bitcoin Cash

• Ripple

• Litecoin

• Dashcoin

• Others

Process Insights:

• Mining

• Transaction

Application Insights:

• Trading

• Remittance

• Payment

• Others

Regional Insights:

• Seoul Capital Area

• Yeongnam (Southeastern Region)

• Honam (Southwestern Region)

• Hoseo (Central Region)

• Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=21885&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

[ad_2]

Source link